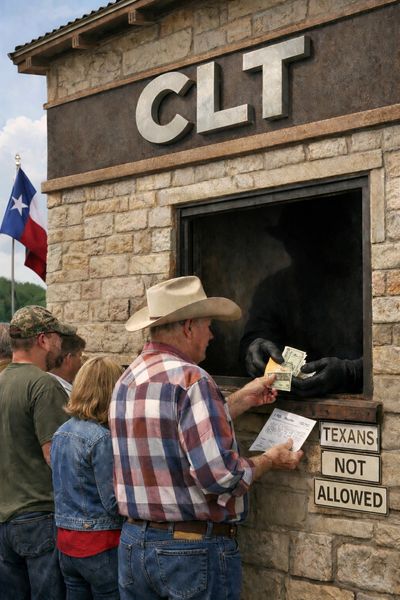

The Pioneer

What is a "Community Land Trust?"

1/24/2026

Dear Texans,

You may or may have never heard of the concept of a "Community Land Trust" or "CLT."

Texas Community Preservation will attempt to summarize just exactly what a CLT is in short. And explain why you care, as a hard-working Texas taxpayer.

A CLT is governed by multiple applicable Texas laws. The most applicable law is Texas Local Government Code Chapter 373B: Community Land Trusts.

As most CLTs are Nonprofits, a CLT is also subject to the Texas Business Organizations Code, Title 2, Chapter 22: Nonprofits.

Under applicable Texas Property Codes, a CLT typically:

- Owns the land

- Leases land for long-term, often 99 years to homeowners

- Impose resale restrictions

- Can create Conveyances, such as Deeds and Restrictive Covenants

- Enforce other rules and limitations

A CLT in Texas is also governed by Texas Property Tax Code 11.182 – Community Housing Development Organizations (CHDO).

In Texas, in order to seek tax credits, a CLT must:

- Be a 501(c)(3)

- Provide “affordable housing”

- Meet income and use restrictions

Some CLTs may also fall under Texas Property Tax Code 11.181 (Charitable Organizations) and 11.1825 (Organizations Constructing or Rehabilitating Low-Income Housing: Property Not Previously Exempt)

Under current Texas law, it may also be possible for a CLT to leverage public (taxpayer) funding sources through Texas Local Government Code such as Chapter 380 – Miscellaneous Provisions Relating to Municipal Planning and Development.

There may be other applicable Texas laws that govern CLTs and there are multiple federal laws that also govern CLTs and CHDOs; however, the details are beyond the scope of this article.

Stay here in the saddle a moment with me, though.

Hard-working Texas taxpayers also need to know, that the Texas Constitution, Article I, Bill of Rights, Section 6, states: "No man shall be compelled to attend, erect or support any place of worship, or to maintain any ministry against his consent."

This means the State of Texas [government], and by extension any county or municipal authorities, cannot compel any man (or woman) to support any particular religious organizations. This also means that these government authorities cannot compel you to support any religious organization with your hard-working Texas taxpayer dollars.

--------------

Now, here's the twist in the trail.

Let's say an organization is a 501(c)(3) in the State of Texas, but claims it's only an "arts and culture" organization. Yet, other information demonstrates the same organization is seeking to establish itself as a CLT, the same organization is seeking out Texas taxpayer funding from a municipal source, has been awarded monies from a Texas taxpayer funded municipal source, and the same organization is only going to provide CLT properties for immigrants and asylum seekers of a particular religious faith?

And hard-working Texas taxpayers will foot the bill?

Texas Community Preservation would argue this violates Texas law, as laid out above.

The above scenario is more than a hypothetical, is currently happening, and Texas Community Preservation has proof.

Stay tuned as Texas Community Preservation evaluates its ability to come forward with its discovery on this vary topic.

Texans deserve better.

Texans deserve the best.

Comal ISD Confirms $19 Million Deficit for 2025-26

Dear Texans,

Per the New Braunfels Herald-Zeitung, Comal ISD will suffer a $19 million dollar deficit during the 2025-26 school year.

Although other factors are at play related to this deficit, most hardworking Texas taxpayers with children in Comal ISD schools are not aware that the State of Texas has been siphoning millions of dollars from local property taxes from Comal ISD taxpayers through Texas Chapter 49, aka "The Robinhood Act."

To foot stomp this point, these are LOCAL PROPERTY TAXES being taken out of Comal ISD and handed to other school districts.

These monies go to other school districts, under a social welfare argument. However, the State of Texas and the Texas Education Agency (TEA) have no discernible mechanism in place to track where an ISD's monies go through Chapter 49. Furthermore, there are no discernible measurements of performance and measurements of effectiveness in place to gauge what a poorer ISD is doing with another ISD's local property tax revenue paid by taxpayers from that district's pool.

Over the past 20 years, Comal ISD has been forced to surrender $75 million dollars and counting, under a "your district is too unfairly wealthy" argument, under Chapter 49. This defies logic, in that Comal ISD already has over ten campuses in its geography that are classified as "Title I" campuses.

"Title I" is a designation that means the income level is so low in and around a campus, the students' families are not able to pay into the Comal ISD property tax payer system. The federal government has to step in, and offset the difference.

So then, why is the State of Texas and the TEA continuing to take tax revenue from Comal ISD every other year, giving it to other ISD's with no accountability in place, when the local property tax revenue is clearly needed to stay inside Comal ISD?

It gets worse.

A significant area of Highway 281 North was annexed by the City of San Antonio (CoSA) through political force and manipulation against the personal neighborhoods of Bexar County Precinct 3 Emergency Services District (ESD) 3 Board Members who happened to live in the 281 North corridor (another separate story). This was prior to Senate Bill (SB)-6 passing in the 86th legislature to protect hardworking Texans from forced annexation.

As a result; however, CoSA has planned scale-level "Affordable Housing" low-income projects up 281 North, in particular with its "Transit Oriented District" (TOD) concept, that is intimately linked to CoSA's "Affordable Housing" and socialist vision for "15-minute cities." These CoSA plans are further enabled by HUD's Community Development Block Grant Program.

Each of these plans will bring in hundreds and hundreds of students per project into already overcrowded Comal ISD schools. The "Affordable Housing" developer and the San Antonio Housing Trust (SAHT) will not pay tens of millions of dollars in property tax revenue to Comal ISD per project.

One of these projects is called "Canyon Pass" off of Overlook Parkway, while the other is called "Creek Bend," at 281 North and Borgfeld Drive.

This is a political and legal quagmire. Comal ISD property tax payers have no political representation to CoSA, barring the few residents that live just inside in CoSA city limits along the 281 North corridor.

But, what about the thousands upon thousands of hard-working Texas taxpayers actually located inside Comal County? They didn't elect CoSA City Council Members obviously.

Yet, CoSA can sign up Comal ISD and Comal County taxpayers for the financial and social peril these social experiments bring into Comal ISD schools.

The victory of CoSA District #9 City Council Member Republican Misty Spears is a refreshing sigh of political relief to hardworking Texas taxpayers in Comal ISD communities.

Notwithstanding, Texas Governor Abbott could stop these programs with a pen stroke.

Mind you, CoSA has also annexed Ralph Fair Road next to Fair Oaks Ranch that is zoned for Boerne ISD.

Boerne ISD has already been forced to surrender $118 million dollars through Chapter 49.

Kendall County taxpayers (where Boerne ISD is based out of) have no political representation to CoSA.

And don't forget, that CoSA has annexed geography in Western Bexar County, that is zoned for Medina Valley ISD, that is based out of Medina County.

The same conundrum applies: Medina County taxpayers have no political representation to CoSA.

As long as CoSA maintains these "Affordable Housing" progressive political goals and social goals and objectives, and believes it has the right to impose them on the likes of Comal ISD, Boerne ISD, and Medina Valley ISD....well then....hard-working Texas taxpayer communities in these areas have the right to politically resist them.

And we will.

What's truly needed, is State of Texas Representatives and State of Texas Senators elected by Texans in these areas to pass legislation to forbid CoSA from making such arrangements.

This begs the question: Where else is this happening across the State of Texas?

Further below are key legislative concepts to preserve our Texas Communities related to this particular topic.

The 90th Legislative Session will be here before you know it in 2027. And the 2026 Texas elections will be here even sooner.

The clock is ticking.

And hard-working Texas taxpayers and voters in these districts.....and across the State of Texas....are watching what their elected officials are doing...and what they are not doing.

-------------------------

LEGISLATIVE CONCEPTS NEEDED TO PRESERVE OUR TEXAS COMMUNITIES

Repeal Texas Chapter 49, Excess Local Revenue

Texas Chapter 49, known as “Recapture,” (aka "Robinhood") of the Texas Education Code should be repealed.

As the name states ("Excess Local Revenue"), politicians and their special interest lobbyists believe various communities are too "unfairly" wealthy, and those hard-working Texas communities should suffer school district property taxes being siphoned from their communities and given to poorer school districts. The law also allows the monies to be used in the general fund of the Texas treasury, and not even for educational purposes.

As an example, since the implementation of Texas Chapter 49, Boerne ISD has had approximately $118 million in local property tax revenue taken out of its district, while Comal ISD has been forced to surrender approximately $75 million in the same manner. (Source: Texas Education Agency)

If Texas Chapter 49 cannot be repealed, the following needs to be passed in the next legislative session:

- The public notification radius for Affordable Housing projects shall be extended to 1 mile. This shall include any Affordable Housing projects that are seeking taxpayer funding for construction loans, taxpayer funding for any tenant assistance including rent, and property tax credits of any kind. Currently, the radius is set to 200 feet from the subject property line.

- The public notification radius for any zoning changes to property to allow for multifamily apartment (MFA) related projects shall also be extended to 1 mile. Currently, the radius is set to 200 feet from the subject property line.

- Any voluntary annexation requests by property owners should also incur a 1 mile public notification radius from the subject property line.

- The regular public notification of the aforementioned circumstances shall continue to use traditional vehicles (signage, fliers, websites, etc.) ; however, shall also now include SMS text messaging to the public within that 1 mile radius from the subject property line. The technology exists to do this today (ex: Amber alerts, COVID alerts, etc.) and shall be financed through cities or counties desiring to make the zoning changes that paves the way for Affordable Housing projects in the first place.

- For voluntary annexation requests by a property owner, the SMS text shall include information with links related to annexation of the property within a city or municipality, and all Public Comment related instructions and procedures, windows of time, and other details to maximize public and taxpayer engagement.

- For rezoning of a property to MFA, the SMS text shall include information related to the Affordable Housing project's Public Comment related instructions and procedures, windows of time, and other details to maximize public and taxpayer engagement.

- Voluntary annexation requests, rezoning of property to MFA, and Affordable Housing project 1-mile public notification requirements, including the newly required SMS text requirement, shall be done so, no less than 1 year prior to the Public Comment window, with a follow-on reminder via SMS text no less than six months prior to the Public Comment window.

Geographic Exemption of Affordable Housing Project by ISD's

Affordable Housing projects bring in hundreds or more students into a public school system in one fell swoop. Various Independent School Districts (ISD) are often targeted by Affordable Housing planners because of their political goals, political objectives, and political and social beliefs. The Affordable Housing students' families do not pay school district property taxes into the often already-overcrowded public school system, while the property owner doesn't pay school district property taxes either. These students often need complete "wrap-around assistance" (band instruments, sports equipment, uniforms, technology peripherals, etc.) from either the ISD, Parent Teacher Student Association (PTSA), or the local Housing Authority or Trust. This increases additional burden on taxpayers or local funds, such as through PTSA's. Affordable Housing project developers will often form Limited Partnerships (LP) with a municipality or county's Housing Authority, Housing Trust, or other housing agencies. These organizations can be tax exempt while the Affordable Housing developer seeks tens of millions of dollars in property tax credits through the Texas Department of Housing and Community Affairs (TDHCA). Often, the Affordable Housing developer will "add on" to an existing project 10 years later, and reapply for millions more in property tax credits through TDHCA programs, and bring in even hundreds more students to the ISD.

If Texas Chapter 49 cannot be repealed, the following needs to be passed in the next legislative session:

- Geographic areas covered by an ISD that are remitting funds back to the TEA under Chapter 49 are exempt from any Affordable Housing projects seeking property tax credits for 5 years from the last year the ISD forfeited monies under Texas Chapter 49.

Accountability of Texas Chapter 49 Monies

If Texas Chapter 49 cannot be repealed, the following needs to be passed in the next legislative session:

- There needs to be a dollar-for-dollar tracer mechanism put in place where our local school district property taxes were drawn under Chapter 49, that’s similar to a revolving line of credit and paid back with interest. We deserve to know where our money is going. We should be able to know what other school districts received monies from our local ISD property taxes, how much, when, and what dollar amounts from our monies went into the State of Texas general treasury. If our monies are being redistributed to a school district with falling enrollment and failing grades, we need to have the option to claw that money back from the State of Texas, with interest, and cover what our school districts went without while that money was outside the district .

5-27-2025

Dear Texans,

Unfortunately, since the beginning of 2025, multiple examples of how not just crime, but violent crime, continues to plague the San Antonio Housing Trust’s (SAHT) low-income “Affordable Housing” projects. Similar projects in the City of San Antonio (CoSA) area were subject of comparable criminal and tragic events.

Animal Cruelty: In January 2025, there was a documented grotesque display in the SAHT’s Culebra Creek Apartments near Alamo Ranch, where an occupant was seen heinously beating a puppy on an apartment balcony. Taxpayers and concerned citizens discovered that Animal Control Services (ACS) calls to this “Affordable Housing” project have been off the charts, including calls to pick-up dead animal remains at or near this location. The Culebra Creek Apartments are one of the SAHT and Pedcor Investments partnership projects. Pedcor Investments Vice President (VP) of Development, Jean Latsha, is married to the Executive Director of the Texas Bond Review Board, Rob Latsha, who processes his own wife’s company’s tax credit applications that the Bond Review Board allocates that results in her company receiving millions and millions of dollars in tax credits per projects. This conflict of interest has been made keenly aware to elected officials, including to Texas Governor Greg Abbott and Texas Attorney General Ken Paxton. Paxton’s signature is the last signature on Texas Bond Review Board bonds that guarantee tens of millions of dollars of tax credits to “Affordable Housing” projects, while Texas taxpayers incur more debt as a result.

Murder:Tragically, in mid-February 2025, a teenager was shot and murdered on the property of the SAHT’s “Affordable Housing” project known as Masters Ranch.

Venezuelan Violent Gang Tren de Aragua: In early May 2025, another one of the SAHT’s “Affordable Housing” projects was also the subject of a multi-agency raid by local law enforcement, state, and federal authorities. Multiple arrests were made related to violent and U.S. government designated Foreign Terrorist Organization Tren de Aragua (TDA) gang members at the SAHT’s Arbor at West Avenue “Affordable Housing” project. As documented in this video, the gang members were using the SAHT’s “Affordable Housing” project as a stash house to smuggle illegal aliens and drugs. Despite taxpayers paying millions of dollars for the construction or refurbishing of these types of projects, which includes paying for tenants’ rent, utility bills, and “complete wraparound assistance” in many cases, authorities seized a million dollars in cash from these gang members, while they were “on the way to the beach,” according to the Bexar County Sheriff’s Department.

Attempted Murder / Home Invasion: Lastly, in late May 2025, a teenager was shot three times during a home invasion at the “Woodland Ridge Apartments” in San Antonio. When Texas taxpayers and concerned citizens researched this location’s status, records show that the project and apartment complex is another 100% tax-exempt low-income home housing project, although there does not appear to be a specific connection to the SAHT.

Egregious Finding: In another non-SAHT related, but Section 8 related apartment complex, on 27 May 2025, a small fetus was discovered in a trash canister at the Canlen West Apartments located at 3536 West Avenue in CoSA. As far back as 2019, through Opportunity Home, formerly known as the “San Antonio Housing Authority” (SAHA), Canlen West apartment complex owners received significant taxpayer funded Section 8 subsidies.

Stolen Vehicle: Ironically, right next to where the SAHT and Pedcor Investments is placing the Creek Bend low-income “Affordable Housing” project on Borgfeld Drive, according to a social media post and related to Bexar County Sheriff case # 2025-BCSO-007462, a resident of Willis Ranch right next to the Creek Bend location, had his vehicle stolen from his driveway. The vehicle was even more ironically recovered at the SAHT and Pedcor Investment’s low-income “Affordable Housing” apartment complex called “Canyon Pass” just down the road off of Overlook Parkway.

Elected Official Speaks Out: Bexar County Appraisal District (BCAD) elected Director Erika Hizel’s public comments at the 2/21/2025 SAHT open meeting, demonstrate how these projects deplete public school financing to the tune of tens of millions of dollars per project, and represent over $200 millions of dollars in public school financing across Bexar County. Ms. Hizel goes onto describe that the "Public Facility Corporation" (PFC) concept, like the SAHT, hasn't changed in 40 plus years. Yet, CoSA still remains the 3rd poor city in the U.S. per capita. So, why keep doing it?

CoSA and its District 9 (D9) continue with plans to lay siege to the 281 North corridor with these low-income “Affordable Housing” projects, that includes geographic areas served by Comal ISD, while Comal County taxpayers have no political representation to the CoSA. To boot, Texas taxpayers recently uncovered that CoSA D9 City Council candidate Angi Aramburu is directly connected to aforementioned Pedcor Investments VP of Development Jean Latsha.

Boerne ISD Be Warned: With CoSA having annexed huge portions of Ralph Fair Road next to Fair Oaks Ranch that is zoned for Boerne ISD, Boerne ISD and Kendall County taxpayer communities should also beware of the criminal peril and financial peril these projects will bring into those communities and school districts, regardless of how politically incorrect it is. The aforementioned reports substantiate such information.

Both Comal ISD and Boerne ISD have been subject of Texas Chapter 49, aka “Robinhood Act” that has taken almost $200 million dollars combined between both school districts property tax revenue streams, where the State of Texas distributes your local property tax revenue to other school districts. This is under a social welfare argument, the hard-working Texas taxpayers in Boerne ISD and Comal ISD are too unfairly wealthy. Yet, the same hard-working Texas taxpayer communities in Boerne ISD and Comal ISD are to sit idly by while HUD, the SAHT, and other special interests aim to upend these communities with similar projects as described above, bring hundreds and hundreds of students per project into these already overcrowded public school districts, and the developer and essentially property owner pay no property taxes into these public school systems. Not to mention, the rent, utilities, and other “complete wraparound assistance” in these projects are also paid for by Texas taxpayers.

Medina Valley ISD Be Warned: Additionally, there are swaths of geography in Western Bexar County where CoSA has annexed land that is zoned for Medina Valley ISD. The dynamics and warning are the same, with Medina County taxpayers having no political representation to CoSA.

Remember, Texas taxpayers are paying for these low-income “Affordable Housing” projects two and three times over or more: taxpayers are paying for the construction costs, taxpayers are paying for the “Affordable Housing” developer fees, taxpayers are paying for the rent, utilities, and complete wraparound assistance in some of these projects, taxpayers are paying for the burden on emergency services serving these projects, and taxpayers are paying for the public school costs associated with these projects by the amount of students they bring into public school systems where the projects are already being placed. And don't forget about Texas Chapter 49 ya'll!

To find out more about what you can do to preserve your community, visit https://www.texascommunitypreservation.org to learn how “voting is not enough,” and that as hard-working Texas taxpayer communities, you must get involved.

The Pioneer

3-17-2025

Dear Texans,

The new 2025 HUD SDDA map is out. See attached graphic to the left.

Hard-working Texas taxpayers in these areas should understand these geographic designations by HUD mean that HUD will financially incentivize Section 8 and low-income "Affordable Housing" developers to target and purchase land in these areas.

Low-income housing developers, such as Jean Latsha with Pedcor Investments, will use attorney lobbyists, to convince land owners to apply to have their properties rezoned for Multi-Family Apartments (MFA) in these areas, before they make an offer to purchase the properties. Jean Latsha's husband, Rob Latsha, is the Executive Director of the Texas Bond Review Board, of which reserves the bond to guarantee the millions of dollars in tax credit her company will receive per project, a conflict of interest hard-working Texas taxpayers have filed complaints with to the Texas Ethics Commission.

Low-income housing developers might also even use attorney lobbyists, such as Rob Killen of Killen, Griffon, and Farrimond, to voluntarily apply to have their properties annexed into a municipality. Once annexed, the property will then be rezoned to MFA, to make way for Section 8 or low-income "Affordable Housing" through the same attorney lobbyist. This has already happened at least once in Boerne, with Boerne citizens only finding out after the project was nearly complete.

The red portions on the HUD SDDA map are considered "metro" areas, while hard-working Texas taxpayers that live in these areas, know these areas are anything but "metro" and represent the pristine and beautiful Texas Hill Country. The "blue" portioned areas are HUD designated "Zip Code Tabulation Areas "ZCTA" which HUD also uses to plan Section 8 and low-income "Affordable Housing."

The "purple" designated areas are considered "non-metro" areas, and also incentivize Section 8 and low-income "Affordable Housing" to target these areas.

Bulverde-Spring Branch and huge swaths of Western Comal County, all zoned for Smithson Valley High School, will remain targeted by HUD for Section 8 and low-income "Affordable Housing."

The Fair Oaks Ranch area that will remain targeted by HUD for Section 8 and low-income "Affordable Housing," is zoned for Boerne ISD.

Medina Valley ISD may also be impacted in far Western Bexar County, where this school district provides public schools in Western Bexar County.

Any Section 8 or MFA "Affordable Housing" projects built in these areas will bring hundreds and hundreds of students into already overcrowded school systems, and receive millions and millions of dollars in property tax credits per project, while the rest of hard-working Texas taxpayers in these communities are expected to make up the difference.

These hard-working Texas taxpayer Hill Country communities are also all in an existential water crisis, where some residents in single family communities are experiencing their wells drying up. Yet, the State of Texas and HUD aim to target these areas with high-density taxpayer subsidized Section 8 or "Affordable Housing” that will consume more water.

The larger Boerne area and the previously identified swaths of Kendall County were removed from the same HUD designation in the 2024 map, comparatively.

Nevertheless, these plans are all a reflection upon political and social goals and objectives to play "social roulette" with hard-working Texas taxpayer communities and disregard for the negative impact high density taxpayer subsidized housing will have in these areas.

Per Bexar County Appraisal District (BCAD) Board of Director Erika Hizel and her public comments made at the 2/21/2025 San Antonio Housing Trust (SATH) public meeting, over $2.2 billion dollars have been pulled out of the property tax revenue system in Bexar County alone by these projects, representing over a couple hundred million dollars that would normally go to public school district financing, while many of these already existing low-income housing projects have low occupancy rates.

So, why build more and in particular place them in Texas Hill Country communities?

A political conundrum remains, in that while the City of San Antonio, or even Bexar County, makes these Section 8 or low-income "Affordable Housing" plans inside areas serviced by Boerne ISD, Comal ISD, or even Medina Valley ISD, taxpayers in Kendall County, Comal County, or Medina County have no political representation to the City of San Antonio or even Bexar County.

The 89th State of Texas Legislature is also in full swing, where it appears that developer lobbyists are convincing even Republican State Representatives and State Senators, to propose and support legislation that is not in the best interest of hard-working Texas taxpayers in single-family residential communities, and even rural semi-suburb communities across the Lone Star State.

Texas Community Preservation has also established contact with the Texas Neighborhood Coalition (https://www.txneighborhoodcoalition.com) and aims to explore partnership and synergistic opportunities with their efforts.

Visit https://www.texascommunitypreservation.org to find out more about how you can preserve our Texas communities.